Zero Trust Network Access is imperative for Cooperative Banks, Says Seqrite CPO Dr. Lalit Mohan at Banking Frontier’s Conference.

At the recent Banking Frontier’s NCBS and FCBA Awards and Conference, Seqrite’s Chief Product Officer, Dr. Lalit Mohan Sanagavarapu, delivered a keynote titled “Zero Trust, Maximum Security: Protecting Cooperative Banks in a Highly Competitive Digital Era.” This address spotlighted the urgent need for digital security in India’s cooperative banking sector, as cyber threats continue to rise and compliance requirements become stricter. The presentation addressed the pressing cybersecurity challenges that these banks face, including rising threats, regulatory demands, and resource constraints, while offering a strategic roadmap to secure their operations through Zero Trust principles.

Cooperative Banks Under Siege

In the keynote, the realities of cyber threats against India’s banking sector were put into perspective. In 2023 alone, Indian banks saw over 1.3 million cyberattacks, amounting to roughly 4,400 attacks per day. Cooperative banks, often constrained by limited budgets and aging IT infrastructures, are especially vulnerable. The challenges are numerous: 54% of these attacks stemmed from unauthorized access, and banks face fines due to non-compliance issues, with the Reserve Bank of India recently penalizing three cooperative banks a total of ₹5.98 crore. On top of this, ransomware attacks have disrupted operations at hundreds of banks, showing how pervasive and severe these attacks have become.

The keynote framed these statistics not just as challenges but as motivators for systemic change, calling for a zero-trust approach to bolster defenses, maintain customer trust, and future-proof security.

Zero Trust as a Strategic Imperative

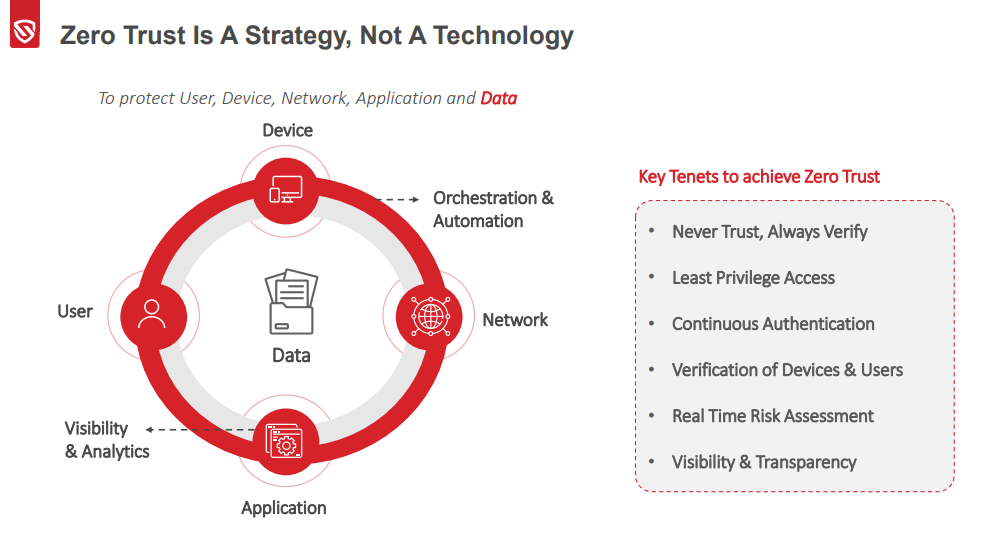

Zero Trust is not a single technology but a comprehensive security philosophy: “Never Trust, Always Verify.” In the banking environment, this model entails strict identity and access management protocols, requiring every user and device to be authenticated and continuously verified before gaining access to sensitive data and applications. Cooperative banks, which often face cybersecurity threats with limited IT resources, benefit from this model’s ability to enforce precise access controls, thereby limiting exposure to threats from unauthorized access and potential data breaches.

The keynote demonstrated how adopting Zero Trust can address long-standing issues with traditional perimeter-based security, helping cooperative banks pivot to a security model that proactively counters modern threats. Zero Trust enables these institutions to manage threats in real time, adapt to evolving risks, and take an active stance against unauthorized access.

Seqrite’s Solutions for Zero Trust and Compliance

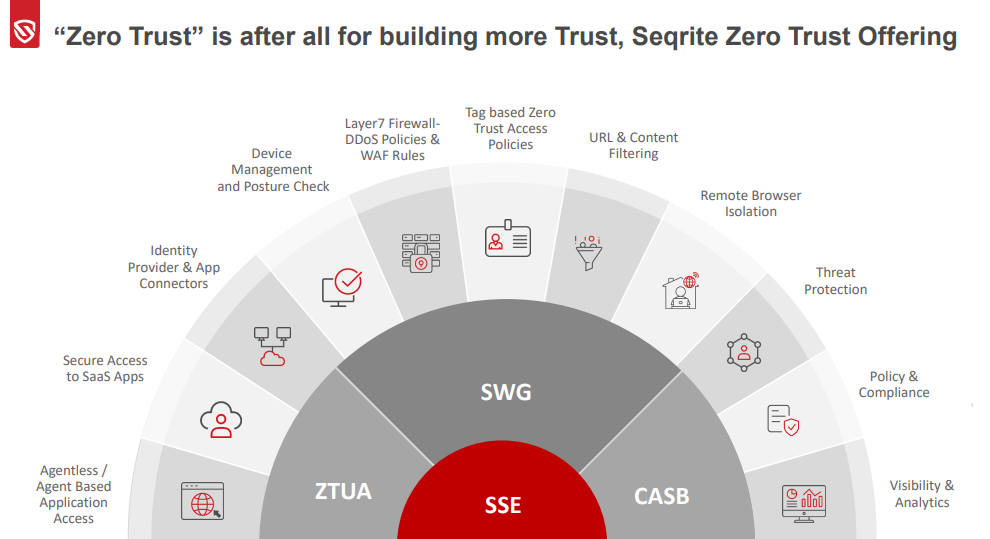

The event showcased Seqrite’s Zero Trust framework, tailored specifically for cooperative banks. This comprehensive security suite addresses their unique security needs and regulatory requirements. It includes features designed to facilitate regulatory compliance, such as secure mail and messaging systems, audit logs, incident management, and continuous monitoring.

A significant highlight was Seqrite Zero Trust Network Access (ZTNA) solution, which leverages a granular access control approach that secures sensitive applications and data based on user identity and device posture. This solution helps cooperative banks limit network exposure by allowing access only to necessary applications, which minimizes the risk of unauthorized network access and data breaches. The Seqrite framework also includes Endpoint Detection and Response (EDR) and Extended Detection and Response (XDR), powered by AI-driven threat-hunting technology, to enable real-time threat detection and monitoring. These features provide a multilayered defense to counter sophisticated cyber threats, making it more manageable for banks with limited IT staff to maintain robust security.

The solutions are also compliant with the cybersecurity frameworks set forth by regulatory bodies RBI and NABARD, giving banks confidence that they are adhering to industry standards. Features such as audit logs, user access control, secure configuration, and advanced incident response equip banks to respond to threats effectively and meet regulatory demands without overwhelming their resources.

Simplifying Security Management

A key takeaway from the event was the emphasis on simplicity. Many cooperative banks operate with minimal IT teams, so Seqrite’s unified security platform is designed to reduce complexity, consolidating cybersecurity management into a single platform. Known as the Seqrite Solution Stack (S3), this platform integrates network management, endpoint protection, and application security into one intuitive dashboard. This “single pane of glass” approach ensures that even with constrained IT resources, cooperative banks can have comprehensive, centralized visibility and control over their security posture.

Seqrite’s approach to simplifying cybersecurity was portrayed as a game-changer for cooperative banks looking to maximize efficiency and protection. With tools like automated threat detection and incident response built-in, IT teams can focus more on strategic tasks and less on managing multiple security tools.

Seqrite’s Innovation and Commitment to Security

The event highlighted Seqrite’s ongoing commitment to innovation. With nine patents focused on anti-ransomware and anti-malware, Seqrite’s solutions offer cutting-edge protection designed to evolve with the threat landscape.

One of Seqrite’s most promising advancements is its use of generative AI (GenAI) to boost productivity through automation, particularly in incident response and threat detection. This innovation enables cooperative banks to detect and mitigate risks before they can escalate into full-blown attacks, a critical benefit for banks with limited IT resources.

Building a Secure Future for Cooperative Banks

The event closed on an optimistic note, envisioning a future where cooperative banks are well-equipped to meet cybersecurity demands and protect their customers’ data.

Seqrite’s Zero Trust solutions offer a path forward for cooperative banks seeking to navigate the complexities of the digital era securely. With a comprehensive, easy-to-manage security platform, Seqrite empowers cooperative banks to protect themselves and their customers, strengthening their role in India’s financial landscape with confidence and innovation.